A year ago, propviews posted on the London land market stand off – what’s going to give. We identified a series of stark challenges effecting the ability for sites to come forward which explained the significant drop in land transactions over 2022 and 2023. These challenges included significant cost inflation, interest rates rises and of course the amendments to building design as a consequence of new fire regulations. We concluded with an expectation that the bottom was near but there wouldn’t be a significant bounce back in 2024.

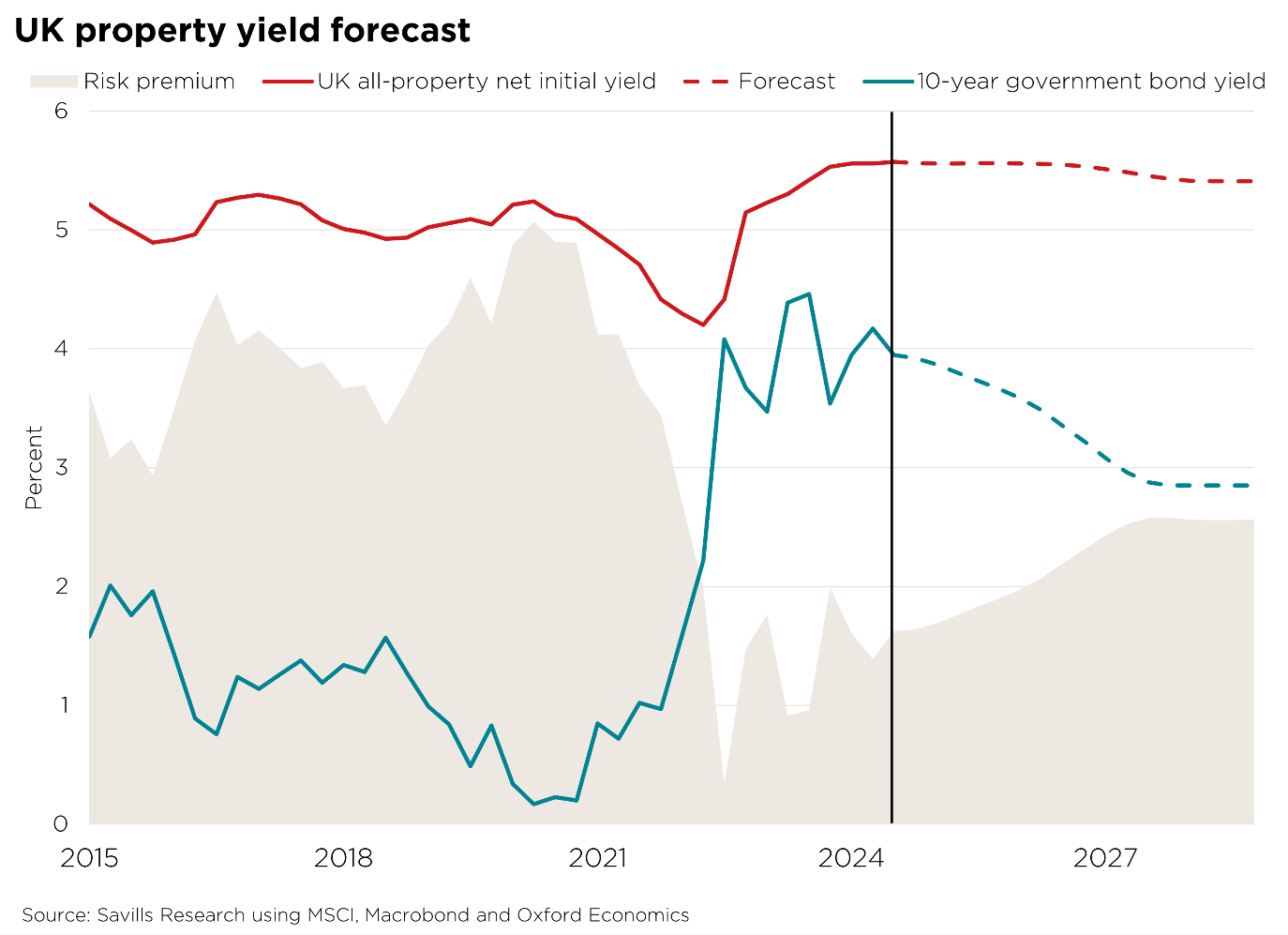

Twelve months later and there are some green shoots. First, central banks are starting to cut interest rates with predictions of further reductions into 2025. This may start to ease some of the pressures on real estate development. Development is a long-term game and many projects mid-stream were caught by the sharp rate rises over 2021 and 2022. Future rate reductions should mean better borrowing terms for construction debt and of course better terms for customers when it comes to mortgages. It could also offer some yield compression for build to rent developers although this may take time to come through. Capital markets will not adjust quickly. It will take time for institutional capital to feel a stable operating environment has been restored and no one really knows where the new risk premium will sit between cap rates and bond yields. The graph below neatly sums up the volatility of the capital markets over the last few years.

Second, a new Government saying positive things about housing goes someway to instilling market confidence. Investors and developers want to know their projects will not be political footballs. For example, it’s helpful that the Government has begun to proactively consider green belt release and introduce a new classification known as grey belt. It is helpful they have stated their ambition to build 1.5 million new homes over this parliament and it is welcome they have brough back demanding housing targets for local authority areas.

National land market stand off

Much danger lies ahead. The fundamentals which led to last year’s post remain and cities like London remain caught in a cycle of higher development costs and unrealistic planning objectives. This led to the land market stand off and there is a an emerging concern the London land market stand off will spread to out of town development as well-intentioned policy collides with commercial complexity.

For example, for the new category of grey belt to succeed, its identification must be clear and simple. However, currently emerging policy is ambiguous. Politicians seemingly happy to open the debate but leave it to the professionals and perhaps the Inspectors to figure out what land is green, grey or indeed brown. This will not do if we are serious about building 300,000 homes a year.

More concerning is a policy requirement of 50% affordable. Strategic land deals can often be years in the making and so a sudden change to a new threshold is likely to reset deals as landowner premiums are diminished or sometimes lost. An excellent blog by Philip Barnes of Barratt sets this out in better detail than I can. According to him, the housebuilder has already pulled three planning applications due to this emerging rule change. The Government is also considering whether to set a national benchmark land value. Land comes in all shapes and sizes and with varying requirements depending on context and existing infrastructure, attempting standardisation will lead to confusion and delay. Simplification of rules is what’s needed not more nationally prescribed boxes and categories as alluded to by Simon Ricketts in his excellent blog post on viab.

If the intention of the policy is to feed more land for housing into the system then policies need also be commercially realistic. Research published in the Times by Viability suggests that a 50% threshold will make 80% of smaller sites unviable for residential development.

Conclusion – the elephant in the room

The land market has shown signs of limited recovery over 2024 but the fundamental challenges preventing land from coming forward for residential development remain. Whilst the Government is right to open up a debate on greenbelt classification, its approach is tepid and may risk causing more barriers. The industry should respond clearly and help the Government get this right.

At the heart of all this is a continued misconception that private housing development can generate a sufficient cross subsidy to deliver affordable homes alone. Andy Hill had it right at the weekend when he said if you are going to build more affordable homes “It’s going to cost a lot of money, because you still need the public subsidy to deal with affordable housing.’