There has been much talk of the kind of recovery the UK is likely to experience once the threat of the current pandemic recedes. Many have tried to visualize the economy in terms of a line graph.

We have had all manner of profiles articulated. References to ‘U’ and ‘V’- shapes have been commonplace. At the beginning of lock down, the majority spoke in optimistic tones of a quick V-shaped pathway.

Such a school of thought now sits in a minority. As the weeks have worn on, more elaborate imagery has been used to convey ideas of the recovery such as a ‘bath shape’ and all manner of zig zags. The recovery is likely to be slow and difficult for many.

However, as with all things in life, reality is more complex than a simple shape on a line graph. I prefer to think of the economy as an aggregation of a many different shapes and growth trajectories. Parts of the economy will return to growth quickly. Other parts will take much longer. Much will depend on how long lock down continues and what kind of restrictions remain as we begin our assent to normality.

A Pocket perspective

From a Pocket perspective, the underlying fundamentals have not changed. This is borne out in some of the indicators we use internally to assess demand.

Traffic to Pocket’s website was up 9% last week and weekly registrations to buy our homes jumped by over 20%. We have also seen strong lines of enquiries coming from our sales offices and virtual viewings of flats has been warmly received by buyers.

I also hear positive noises from other developers who are finding innovative ways to talk to customers and progress sales in this uncertain time. The demand for affordable home ownership has not gone away and the demand for housing across most tenures remains strong.

Residential resilience

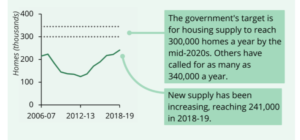

Resilience within residential development is a function of many things but at its root lies a consistent under supply of new homes as illustrated in the below MHCLG chart of housing supply set against target. Whilst supply has gradually ticked up from a post 2008 slump, it has not kept pace with the stated requirement to achieve 300,000 new homes per annum.

It’s important to note that under supply was particularly prevalent in demand hots spots. MHCLG statistics, recorded 35,959 ‘Net additional dwellings’ in London in 2018/19. This falls way short of London Plan expectations. There are multiple reasons for such a substantial shortfall one being of course Brexit. This would suggest there is untapped demand which could offer resilience in this current crisis.

Known unknowns

Of course, none of this is as simple as a supply v demand graph. There are quite a few known unknowns emerging which if they continue will complicate the picture. The first is of course how long the crisis will go on for.

International Monetary Fund’s updated World Economic Outlook indicates a global contraction of 3% in 2020 rebounding to 5.8% growth in 2021. However, this is predicated on a return to business as usual later this year.

More interesting to developers in real estate will be the amount of jobs currently being lost and so the affect this will have on spending power and affordability. The Institute for Employment Studies (IES) reckons the loss is between 1.5 million and 2 million jobs and this comes on top of those workers who have been furloughed by bosses.

What we don’t know is the nature of these jobs and how quickly they will return. Even if they were not in the main prospective homeowners, such a loss could have an impact on pricing particularly in areas where supply and demand are closer to parity.

A countervailing factor and one which is immeasurable is how people will choose to spend their money post this crisis. There is some talk that with foreign travel now out for the foreseeable, people will use their nest eggs to buy homes instead. This strikes me as Panglossian sentiment.

Finally, we know that taxes will rise. Property wealth in the UK is substantial and so HM Treasury may find the urge to initiate a raid irresistible. Such a move is likely to affect pricing in the medium term and may dampen the racy expectations of house price inflation in 2021.

Time will tell. Let me know your thoughts and sorry that I haven’t produced a blog in some time! Time flies…